Key data study of the ‘Fitness Industry Austria 2024’: Fitness facilities, membership structure and membership fees

The Association of Leisure and Sports Companies in the Austrian Federal Economic Chamber (WKÖ), in cooperation with the German University of Prevention and Health Management (DHfPG), has conducted the first study on the ‘Key Data of the Austrian Fitness Industry 2024’. The key figures for the fitness industry shown in the study show that the signs are pointing towards growth. A total of 1.2 million people in Austria train in fitness and health facilities.

The study, commissioned by the Association of Leisure and Sports Companies in the Austrian Federal Economic Chamber (WKÖ), was carried out in collaboration with the German University of Prevention and Health Management (DHfPG). Its experts have been collecting fitness figures for Germany for decades and, since 2022, also for Switzerland. (Read more: ‘Key data Switzerland 2024’)

Scientific foundation

“We are pleased to now be conducting the key data study in Austria as well, as this will enable the industry to finally underpin its important role and strength with scientific results,” emphasize the two study authors from the DHfPG, Prof. Dr. Sarah Kobel and Ralf Capelan.

“The major industry study shows that the Austrian fitness industry has recovered after the difficult pandemic years and is now growing strongly.”

_______________________________

Christian Hörl – Federal industry spokesman and committee member of the WKÖ

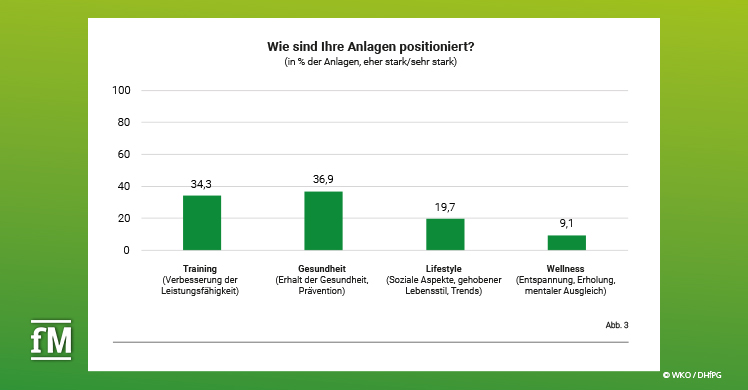

“In addition, the relative majority of fitness businesses (36.9%) have positioned themselves primarily in the health sector and are thus making an indispensable contribution to public health,” says federal industry spokesman Christian Hörl, commenting on the current results.

Looking beyond national borders

Christian Hörl continued: “The results of the study impressively underline the importance of our companies for the well-being and quality of life of the population in this country.”

This cooperation allows a well-founded view beyond national borders and a country comparison in the DACH region, which in this way enables an even more comprehensive market assessment and also offers further synergies.

Why a key data study on the fitness industry for Austria?

Market studies generally create transparency and enable players to assess the market, recognize and classify opportunities and risks, and identify potential for success in order to better tailor their offerings to the needs of their customers.

fM WhatsApp channel: Follow now!

For the Austrian fitness industry, this means that it can draw on important industry metrics such as facility, membership or sales figures, compare its positioning and service portfolio with the overall market and thus optimize its strategic and operational business.

Structure of fitness facilities in Austria

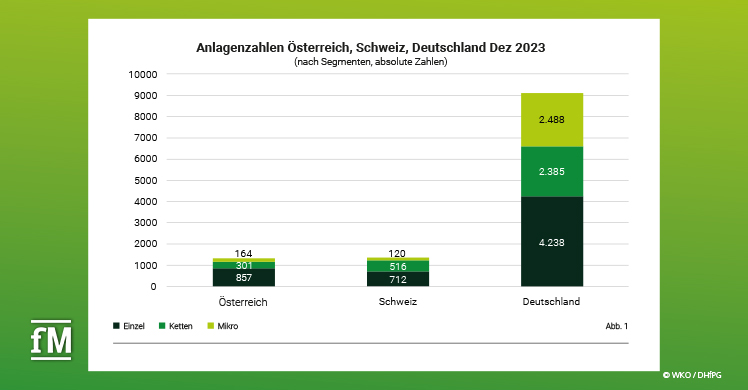

The Austrian fitness market comprises a total of 1,322 fitness and health facilities as of December 31, 2023. 857, or almost two thirds of the facilities (64.8%), are assigned to the individual segment (fitness facilities with at least one and a maximum of four operating locations and a total area of more than 200 square meters per facility).

A total of 301 or 22.8 percent of the facilities are chain operations, which are classified as such if they are part of a network of five or more operating sites and have a total area of more than 200 square meters per facility.

Don’t miss any Fitness-NEWS more!

Follow us on WhatsApp, Facebook, LinkedIn & Instagram

164 facilities (12.4%) have an area of 200 square meters or less, usually occupy a special segment, are specialized for a specific target group with a limited offer and thus belong to the micro segment.

This means that the Austrian market differs somewhat from the Swiss market, where the individual segment is less dominant than in Austria and the micro segment is also somewhat weaker at 8.9 percent.

Both markets differ from the German market, in which the micro segment accounts for 27.3 percent of the systems, mainly due to the strong EMS market (see Figure 1).

Membership structure in Austria

Around 1.2 million members trained in domestic fitness and health facilities during the 2023 period under review. Compared to the previous year (1.1 million), this represents an increase of 5.7 percent.

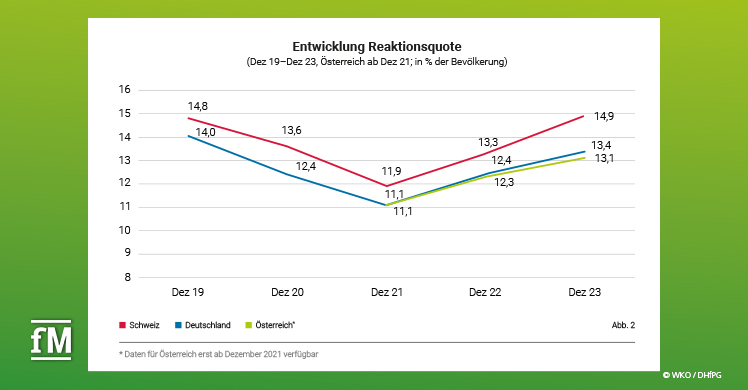

Overall, 13.1 percent of the total population used the services of a commercial fitness and health facility in 2023. The response rate is thus slightly below the response rate in Germany (13.4%).

Switzerland is the most fitness-oriented of the three countries, with 14.9 percent (see Figure 2). If we only consider the particularly relevant target group of 15- to 65-year-olds, the response rate in Austria is 17.5 percent.

The average person exercising in Austria is 38.8 years old, which is younger than in neighboring countries Germany (40.6 years) and Switzerland (40.0 years). Over 54 percent of members in Austrian fitness facilities are female, 45.8 percent male.

In Germany, a similar distribution can be seen (53.9% female, 46.1% male), while in Switzerland the gender ratio is more balanced (51.0% female, 49.0% male).

Members come to training 1.1 times per week

Austrian fitness facilities recorded an average of 4094.4 check-ins per month and facility in 2023. Converted to the members in the facilities, this means that members came to train an average of 1.1 times per week in 2023.

This means that the members in Austria trained just as often as the members in Germany, who also trained 1.1 times a week. Here too, the Swiss members are the leaders with an average weekly training frequency of 1.3.

Fitness industry as a healthcare provider

While the fitness markets in Austria, Switzerland and Germany differ with regard to the parameters mentioned, there is agreement with regard to positioning. The relative majority of facilities in all three national markets are positioned primarily in the health sector.

This makes it clear that fitness facilities have internalized their role as important health service providers in the market and are aligning themselves accordingly.

In the Austrian market, 36.9 percent of the facilities are primarily positioned in the area of health (maintaining health, prevention) (see Fig. 3), followed by training (performance improvement, 34.3%), lifestyle (social aspects, upscale lifestyle, trends, 19.7%) and wellness (relaxation, recovery, mental balance, 9.1%).

Membership fees in the gyms

The average monthly fee for a membership in a fitness facility in Austria is 49.36 euros (gross) in the year under review, 2023. Facilities in the individual segment charge an average of 55.99 euros per month, facilities in the chain segment 41.12 euros.

Pictures from the key data presentation

Training in micro-systems costs an average of 72.93 euros per month. Around three out of four systems in Austria (75.4%) have increased their membership fees in 2023 compared to 2022. The average increase is 2.99 euros.

Cautiously optimistic mood regarding the labour market

A fitness facility in Austria employs an average of 15.6 people. Looking ahead to 2024, 77.2 percent of operators are confident that they will be able to cover their staffing needs.

19.1 percent are unsure, and only 3.7 percent expect not to find enough staff in 2024. Against the background of the negative developments in employee numbers in many sectors due to the Corona crisis, these figures are all the more positive.

Forecast and outlook

About every second company (48.1%) assesses its economic situation as of December 31, 2023 as satisfactory. 33.2 percent rate their economic situation as (rather) good. Slightly less than one in five companies (18.7%) assesses their economic situation as (rather) bad.

13.4 percent of companies expect their economic situation to (tend to) worsen in 2024, 45.0 percent expect no change and 41.6 percent expect an improvement. Overall, the mood in the industry is positive, although more pessimistic than in the two neighboring countries.

In Switzerland in particular, optimism in the industry is high: 71.0 percent of companies rate their economic situation in 2023 as (rather) good, 91.7 percent expect an improvement in 2024. In Germany, 51.8 percent rate their economic situation in 2023 as (rather) good, 76.5 percent expect an improvement in 2024.

Conclusion

The ‘Key Data of the Austrian Fitness Industry 2024’ examines the Austrian fitness market in such depth for the first time. This study lays the foundation for an annual survey of key data in order to be able to show the development of important parameters and react accordingly – as in neighboring countries.

The status quo of the fitness market in Austria and the forecast developments are overall good and promise a similarly positive development as in the two neighboring countries.

Christian Hörl concludes: “The market study not only underlines the importance of the industry, it also creates transparency and makes it possible to better assess the market, recognize and classify opportunities and risks, and identify potential for success in order to tailor the offering even better to the needs of customers.”

You can find the complete study results here.

Ethel Purdy – Medical Blogger & Pharmacist

Bridging the world of wellness and science, Ethel Purdy is a professional voice in healthcare with a passion for sharing knowledge. At 36, she stands at the confluence of medical expertise and the written word, holding a pharmacy degree acquired under the rigorous education systems of Germany and Estonia.

Her pursuit of medicine was fueled by a desire to understand the intricacies of human health and to contribute to the community’s understanding of it. Transitioning seamlessly into the realm of blogging, Ethel has found a platform to demystify complex medical concepts for the everyday reader.

Ethel’s commitment to the world of medicine extends beyond her professional life into a personal commitment to health and wellness. Her hobbies reflect this dedication, often involving research on the latest medical advances, participating in wellness communities, and exploring the vast and varied dimensions of health.

Join Ethel as she distills her pharmaceutical knowledge into accessible wisdom, fostering an environment where science meets lifestyle and everyone is invited to learn. Whether you’re looking for insights into the latest health trends or trustworthy medical advice, Ethel’s blog is your gateway to the nexus of healthcare and daily living.